China's State Administration for Market Regulation (SAMR) has characterized its investigation into U.S. chipmaker Qualcomm's acquisition of Israeli firm Autotalks as a standard antitrust enforcement measure. The regulator confirmed it acted under China's Anti-Monopoly Law after evidence suggested the $350 million deal could harm market competition.

Timeline of Regulatory Action

According to SAMR officials, Qualcomm received written notification in March 2024 to submit the transaction for review and refrain from closing the deal prematurely. While the company initially agreed to abandon the acquisition, it reportedly completed the transaction in June 2025 without regulatory approval or communication.

Broader Economic Context

The investigation occurs against a backdrop of intensifying U.S.-China technological competition, particularly in semiconductors and green energy sectors. Analysts observe that despite strategic rivalries, both economies maintain deep interdependence in critical supply chains.

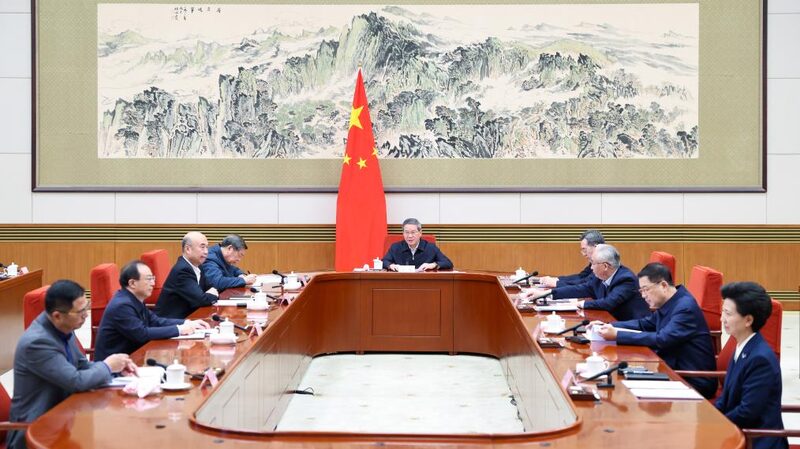

Chinese authorities reiterated their commitment to 'technological self-reliance through open cooperation,' emphasizing that antitrust reviews apply equally to domestic and foreign enterprises. The stance aligns with China's push for industrial upgrading while maintaining global innovation partnerships.

Next Steps

SAMR officials confirmed the investigation will proceed objectively under legal frameworks. The case highlights China's evolving antitrust enforcement mechanisms as it balances market regulation with international economic engagement.

Reference(s):

cgtn.com