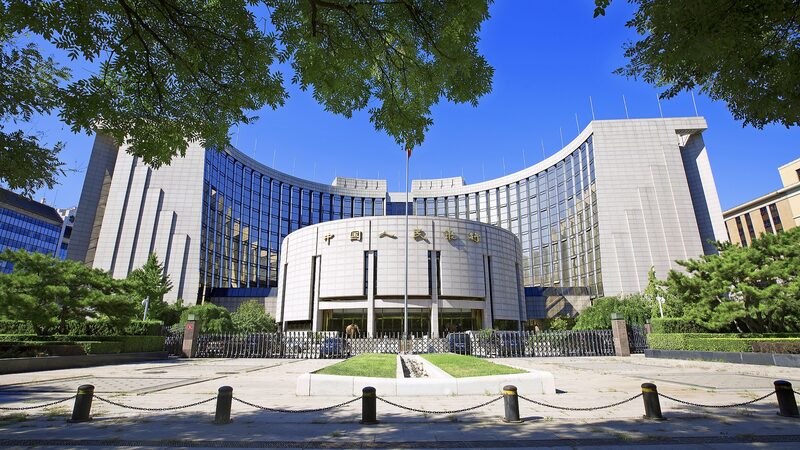

The People's Bank of China (PBOC) has unveiled plans to maintain proactive monetary measures through 2026, with Governor Pan Gongsheng confirming potential reserve requirement ratio (RRR) reductions and interest rate cuts to stabilize financial markets and stimulate growth.

In an exclusive interview with CMG, Pan emphasized the central bank's commitment to 'moderately loose' policies aimed at ensuring sufficient liquidity while balancing price recovery objectives. The strategy aligns with China's broader push for high-quality economic development amid global economic uncertainties.

'We retain substantial policy flexibility this year,' Pan stated, highlighting ongoing efforts to reduce corporate financing costs through coordinated regulatory oversight. The announcement comes as analysts predict increased infrastructure spending and consumer market stimulation across the Chinese mainland.

Financial markets across Asia showed cautious optimism following the announcement, with regional indices edging upward in early trading. The PBOC's planned interventions are expected to particularly benefit manufacturing and technology sectors critical to China's economic transformation.

Reference(s):

cgtn.com