As the Chinese mainland enters 2026 with renewed economic momentum, foreign financial institutions are highlighting opportunities in its strategic pivot toward advanced manufacturing and technological self-reliance. Morgan Stanley's chief China economist Robin Xing notes, "The current year marks a tipping point where innovation contributes over 60% of GDP growth – this structural shift creates resilient sectors for global investors."

J.P. Morgan's China Equity Strategy head Wendy Liu identifies green tech and AI infrastructure as key 2026 investment themes: "Decarbonization initiatives and smart manufacturing upgrades present $1.2 trillion in addressable markets through 2030. Cross-border partnerships will accelerate this transition."

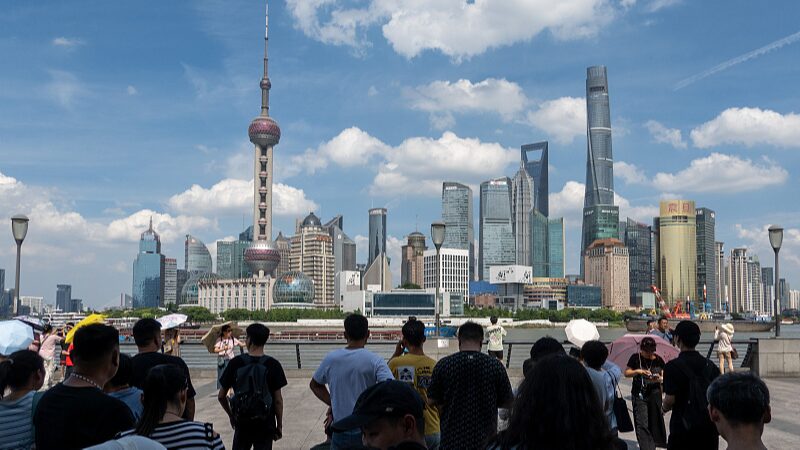

Analysts emphasize that recent policy adjustments stabilizing property markets while boosting high-tech industrial parks have improved investor sentiment. The Shanghai Composite Index's 18% year-over-year gain reflects growing confidence in these coordinated reforms.

With consumption patterns evolving, sectors combining digital services and sustainable solutions – particularly in electric vehicles and renewable energy storage – are drawing significant overseas capital inflows. As cross-strait economic cooperation expands, Taiwan-based tech firms are increasingly collaborating with mainland counterparts in semiconductor R&D projects.

Reference(s):

cgtn.com