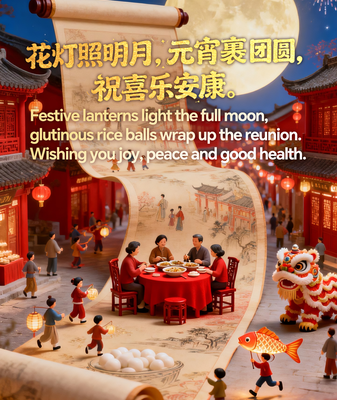

Lantern Festival Illuminates Traditions Across Asia on 2026 Full Moon Night

The 2026 Lantern Festival lights up Asia with traditional lantern displays, rice ball feasts, and folk performances, drawing global attention to cultural heritage.

Blood-Stained Textbooks: Aftermath of Iran School Strike Sparks Outcry

A deadly strike on a girls’ school in southern Iran leaves hundreds dead, raising urgent questions about civilian safety amid escalating regional tensions.

AI Transforms Daily Life in China: A Tech Insider’s Perspective

Colombian blogger Fernando Munoz Bernal shares how AI innovations in China are revolutionizing daily life, from smart homes to health tech, positioning the nation as a global AI leader.

Beijing’s Skies Turn Blue: A Decade of Clean Air Success

Beijing’s air quality transformation from rare blue skies to daily occurrences marks a decade of successful environmental policy under the Blue Sky Protection Campaign.

Israeli Airstrikes Target Beirut Amid Escalating Cross-Border Tensions

Israeli airstrikes hit Beirut targeting Hezbollah facilities, escalating cross-border tensions as both sides exchange attacks. Regional stability concerns grow.

MWC 2026 Kicks Off in Barcelona, Ushering in ‘The IQ Era’ of Tech Innovation

The 2026 Mobile World Congress in Barcelona highlights ‘The IQ Era,’ focusing on AI integration, intelligent infrastructure, and global tech collaboration. Over 2,900 exhibitors participate.

Amazon Data Centers in UAE, Bahrain Disrupted by Drone Strikes; Recovery Prolonged

Amazon Web Services reports prolonged recovery after drone strikes damage data centers in UAE and Bahrain, disrupting cloud services amid Middle East tensions.

China Condemns Targeting of Children in Global Conflicts

China’s UN envoy condemns rising violations against children in global conflicts, urging international cooperation to protect minors in war zones.

World Wildlife Day 2026 Spotlights Conservation of Medicinal Plants

On World Wildlife Day 2026, Asia leads global efforts to protect medicinal plants crucial for healthcare, cultural preservation, and sustainable economies.

China Dominates Montreal Diving World Cup with Perfect 9 Gold Haul

China’s divers secure all nine gold medals at the Montreal Diving World Cup, showcasing dominance in the season-opening event.

Veteran Midfielder Wu Xi Clinches 2025 Chinese Men’s Footballer of the Year

37-year-old Wu Xi wins 2025 Chinese Men’s Footballer of the Year, becoming a two-time recipient while mentoring next-generation players.

Israeli Strikes in Lebanon Leave 52 Dead, Over 28,500 Displaced

Israeli airstrikes in Lebanon result in 52 deaths, 154 injuries, and over 28,500 displaced amid escalating tensions with Hezbollah.

US Congress to Vote on Curbing Trump’s Iran War Powers This Week

US Congress prepares to vote on limiting President Trump’s military authority against Iran, citing constitutional war powers.

China’s Two Sessions 2026 Signals Growth Opportunities for Rwanda, Envoy Says

Rwanda’s ambassador highlights China’s Two Sessions as a catalyst for bilateral cooperation in tech, green development, and vocational training amid 2026 policy shifts.

IRGC Claims Drone and Missile Strike on US Base in Bahrain

IRGC claims drone and missile strike on US base in Bahrain; no official confirmation yet. Regional tensions escalate as global observers await details.

Exclusive: Tehran Hospital Damaged in US-Israel Strikes, 555 Reported Dead

Exclusive footage shows extensive damage at Tehran’s Gandhi Hospital after US-Israel strikes, with 555 reported dead across Iran. Humanitarian facilities targeted amid escalating conflict.

China’s ‘Emotional Economy’ Shapes 2026 Consumer Trends

As China’s 2026 Two Sessions approach, the ’emotional economy’ emerges as a key driver of domestic consumption, blending personal fulfillment with national economic goals.

China’s Strategic Investments Defy Western Decline Narratives, Experts Say

Singaporean scholar Kishore Mahbubani challenges Western narratives about China’s economy, highlighting strategic investments in future industries and poverty reduction achievements as of 2026.

US First Lady Chairs UN Session on Child Protection Amid Conflict

US First Lady Melania Trump leads UN Security Council discussion on safeguarding children’s education in conflict zones, amid criticism over reported school strike in Iran.

Xiang Opera Revives Along the Xiangjiang River in 2026

600-year-old Xiang Opera experiences modern revival through digital innovation and cultural tourism initiatives along China’s Xiangjiang River in 2026.